TL;DR

If you manage claims internally, choosing the right claims management software can be the difference between clear oversight and operational risk.

In this guide, we break down how to choose the best claims management software for in-house teams in 2026, compare modern cloud-based platforms with legacy approaches and explain what features actually matter when managing claims internally.

Why trust this guide: This guide is based on our experience operating Claimable and real-world use by in-house claims teams managing thousands of internal claims.

Managing claims internally is complex. In-house claims teams must balance compliance, documentation, cross-department collaboration and real-time visibility across the entire claims lifecycle.

Yet many organisations still rely on spreadsheets, shared inboxes, or disconnected tools that slow down claims processing and increase risk.

There is a need for claims software that enables efficient, compliant, and collaborative internal claims management, independent of insurers and TPAs.

In this guide, we’ll explore what to look for in the best claims management software for in-house claims teams in 2026, common challenges internal teams face and why modern cloud-based claims platforms like Claimable are replacing legacy systems.

What Is Claims Management Software for In-House Teams?

Claims management software for in-house teams is designed to help organisations manage internal claims such as employee liability, workplace incidents, property damage, supplier disputes and insurance-backed claims, without the need to involve third parties.

For example, in-house teams use Claimable to manage employee incident claims alongside property damage in one place. Claims handlers can track documentation, approvals and communications in one place, while HR, Legal and Finance teams access read-only views to stay informed without disrupting workflows.

Unlike insurer-focused platforms, a claim systems for in-house teams prioritises:

- Internal collaboration

- Customer service and communication

- Cost control

- Auditability and compliance

- Flexible workflows across departments

- Ease of use

Why do in-house claims teams need dedicated claims software?

In-house claims teams need dedicated claims management software because they manage diverse internal claims while balancing compliance, collaboration and customer service responsibilities that generic tools cannot support effectively.

Unlike insurers or large TPAs, in-house claims teams face unique challenges:

- They handle diverse claim types from employee and compensation claims to property, supplier or liability cases

- They need to collaborate with departments like HR, Legal, Finance and Operations, without adding complexities to each team

- They have to maintain compliance, consistency and audit trails for accurate reporting

- They are often asked to report to management with insights that influence company strategy

- Claim outcomes have great impact on the company and its customers

- Budgets are often limited compared to big insurers

Without a dedicated claims system, many in-house claims teams rely on spreadsheets, shared inboxes or disconnected tools. These approaches do not scale, increase the risk of errors and make it difficult to maintain visibility, accountability and compliance across the claims lifecycle.

Modern claims management platforms such as Claimable centralise all internal claims in one system, automate repetitive administrative tasks and provide real-time visibility for all stakeholders.

What Features Matter Most in Internal Claims Management?

Human-first Automation

Human-first automation helps in-house claims teams reduce administrative workload without removing professional judgement or control.

Many organisations still rely on manual, centralised workflows and paper-based processes that slow claims handling and increase operational risk. [1]

For in-house teams, maintaining human oversight is essential, as claims often directly affect employees and handling them with care is vital for building customers' trust, loyalty and lasting relationships.

Claimable automates repetitive administrative tasks such as task reminders, notifications, document generation and communications. This enables claims handlers to focus on decision-making, relationship management and consistent claim outcomes.

Centralised Claims View

A centralised claims view ensures that all claim data, documents and communications are stored in a single, secure system accessible across the organisation.

In-house claims teams frequently collaborate with HR, Legal, Finance and Operations. When claims information is fragmented across systems, visibility and consistency suffer. Research shows that internal fragmentation is one of the main barriers to effective claims management. [2] For example, one in-house claims team using Claimable consolidated claims data previously spread across HR systems, finance tools and shared drives. This reduced the time spent preparing reports and locating claims data for internal reviews.

Flexible Integrations

Flexible integrations allow claims management software to connect with existing business systems such as HR platforms and vendor systems.

By integrating claims data with the wider business, in-house teams reduce duplicate data entry, minimise manual errors and ensure information remains consistent across departments. This supports scalable operations without increasing IT complexity.

Modern platforms like Claimable typically provide APIs and no-code integrations to support organisational needs as they evolve.

Read-Only Claims Access

Read-only claims access enables stakeholders to view claims without editing them, supporting transparency without disrupting daily claims handling.

Managers, finance teams and other departments gain real-time visibility into claim status, costs and outcomes, while claims handlers retain control over workflows and decisions. This controlled access model improves governance, accountability and cross-department collaboration.

Reporting

An important part of managing claims is the ability to gain an overview of volume and performance to inform company strategy. Having an at-a-glance view of open claims and real-time claims data helps drive decisions and operational efficiency.

The ability to export data quickly is often an overlooked feature, yet without it, data reviews and analysis can become unnecessarily slow and cumbersome.

User-Friendly Experience

A user-friendly experience ensures claims management software can be adopted quickly across teams without extensive training or technical expertise.

Intuitive workflows help standardise processes, reduce user error and improve compliance. Cloud-based software also enables secure access from any location, supporting hybrid and distributed teams.

Claimable is an example of a cloud-based claims management platform built to be intuitive and easy to adopt, enabling in-house teams to manage claims efficiently with minimal training.

Cloud-Based & Secure

Choosing a hosted, secure cloud-based solution means in-house claims teams no longer need to worry about data protection, server maintenance or software updates. Instead of spending time and resources managing security, teams can focus entirely on handling claims faster, more accurately, and with complete confidence that their claims data is safe.

Claimable allows you to benefit from enterprise-level data protection without the overhead of managing infrastructure or security protocols internally.

Affordable and Scalable Pricing

Affordable and scalable pricing in claims management software means to transparent costs, predictable billing and pricing that does not increase disproportionately as claims volume grows. For in-house claims teams, this ensures long-term cost control without hidden fees or unexpected implementation charges.

Claimable is designed to remain affordable even as organisations scale, avoiding the setup costs and complex pricing models common in legacy claims systems.

- Transparent pricing: No setup fees, hidden charges or paid add-ons that complicate budgeting.

- Scales with usage: Pricing grows sensibly with team size, without penalising expansion.

- Lower total cost of ownership: Claimable is cloud-based software and fully maintained and supported by the Claimable team, removing infrastructure, maintenance and extensive training costs.

How do I Choose the Right Claims Management System?

When choosing in-house claims platforms, decision-makers should evaluate functionality, scalability, security, integrations and total cost of ownership.

- What claim types do you handle (internal employee liability, vendor damage, warranty, insurance‐backed, etc)? Does the software support these claim types?

- Can it scale with your claims volume?

- What systems must it integrate with? Does the vendor offer an API?

- What is your IT capacity?

- What reporting capabilities are included? Can you export data easily?

- What security/compliance features are provided (audit logs, role-based access, encryption, multi-factor authentication)?

- What is the vendor’s experience in the claims space (especially for in-house/internal teams vs insurer)?

- What are the cost models: per-user, per-claim, tiered subscription? Are there hidden implementation costs?

- What is the rollout timeline? How much training and support is offered?

Why Claimable is the Best Choice for In-House Teams?

Claimable isn’t repurposed insurance software or a repackaged legacy product. Claimable is designed specifically for organisations that want full control over internal claims without the cost, complexity or long contracts associated with legacy systems.

With Claimable, you get:

- A cloud-based claims management system that’s easy to use and quick to deploy

- An at-a-glance view of all your claims

- Free read-only users

- Flexibility and support for multiple claim types

- Quick and simple exporting of your data

- Reporting and categorisation of your claims

- A fully documented API and Zapier access for seamless integrations

- Transparent and scalable pricing

- A user-friendly experience that boosts customer satisfaction and team productivity

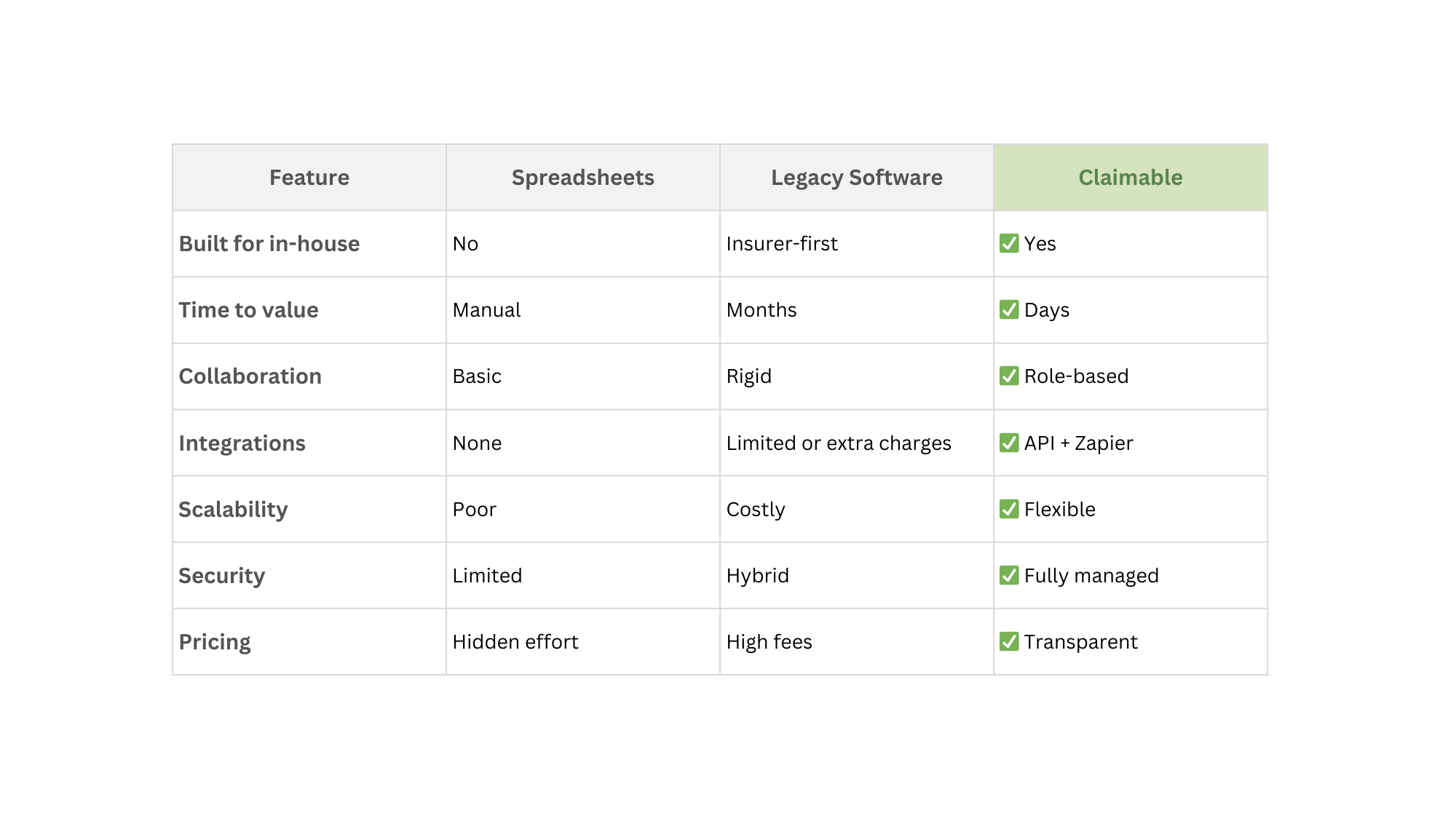

Claims Management Software Comparison for In-House Teams

For in-house claims teams, cloud-based claims management software like Claimable offers better visibility, compliance and scalability than spreadsheets or legacy systems.

Built for in-house claims teams

- Spreadsheets: ❌ Not designed for claims teams

- Legacy systems: ❌ Insurer-focused

- Claimable: ✅ Purpose-built for claim teams

Setup & time to value

- Spreadsheets: 🥱 Fully manual and depend on person implementing it

- Legacy systems: 🕗 Long implementations

- Claimable: ✅ Ready to use and live in days

Audit trails & compliance

- Spreadsheets: ❌ Not supported or limited

- Legacy systems: 🤔 Limited or complex

- Claimable: ✅ Built-in audit logs

Reporting & visibility

- Spreadsheets: 🥱 Manual reporting

- Legacy systems: 🕗 Static

- Claimable: ✅ Real-time insights

Scalability & pricing

- Spreadsheets: ❌ Break at scale

- Legacy systems: 💰 Additional fees and long contracts

- Claimable: ✅ Transparent pricing that scales

Data Exporting

- Spreadsheets: ✅ Immediate

- Legacy systems: 🕗 Require support

- Claimable: ✅ Immediate, in one click

Claimable helps in-house teams transform claims management by combining automation and collaboration enabling faster, more accurate claims and exceptional customer service.

Take control of your entire claims lifecycle, unlock deeper insights from your claims data and deliver the customer experience your business deserves.

👉 Discover Claimable, get a free trial.

Frequently Asked Questions

What is the best claims management software for in-house teams?

The best claims management software for in-house teams is a cloud-based platform that gives organisations full visibility, built-in audit trails and seamless cross-department collaboration for managing internal claims. Claimable is purpose-built for in-house claims teams, replacing spreadsheets and legacy insurer-focused systems with a modern, secure and scalable claims management solution.

Can in-house claims be managed without insurers or TPAs?

Yes. Many organisations manage claims internally using in-house claims management software. These systems support employee, property, supplier and liability claims while maintaining compliance and cost control.

Why are spreadsheets risky for internal claims management?

Spreadsheets are risky for internal claims management because they lack audit trails, access controls and real-time visibility. They are prone to errors and data loss, especially when multiple teams collaborate on the same claims.

Is cloud-based claims management software secure?

Yes. Cloud-based claims management software uses encryption, role-based access and audit logs to protect sensitive data. It also reduces security risks by removing the need for internal server management and manual updates.

How quickly can in-house teams implement Claimable?

In-house teams typically implement Claimable in days rather than months. Most teams start with a small number of claim types and workflows, then expand as confidence grows. Because the system is cloud-based and intuitive, extensive training or IT involvement is rarely required.

What types of claims can Claimable manage?

Claimable can manage a variety of claims in one system, including employee liability, workplace incidents, property damage, automotive, supplier disputes and insurance-backed claims.

Does in-house claims management software support compliance and audits?

Yes. In-house claims management software supports compliance through audit logs, role-based permissions and centralised documentation. This makes audits easier and ensures consistent, traceable claims handling.